FAST Channels: The Complete Guide for Publishers and Ad Ops Teams

Free Ad-Supported Television (FAST) channels have emerged as one of the most significant trends in the streaming video landscape, offering publishers a compelling opportunity to monetize content while providing viewers with free, linear-style programming. As traditional cable TV continues to decline and viewers increasingly turn to streaming platforms, FAST channels represent a bridge between the familiar linear TV experience and the flexibility of on-demand streaming.

What Are FAST Channels?

FAST channels are streaming television channels that broadcast programming in a linear, scheduled format similar to traditional TV, but are distributed over the internet and monetized exclusively through advertising revenue. Unlike subscription-based streaming services or pay-per-view models, FAST channels provide content completely free to viewers in exchange for watching advertisements.

The key characteristics that define FAST channels include:

- Linear programming: Content follows a predetermined schedule, just like traditional broadcast television

- Ad-supported revenue model: Monetization relies entirely on advertising revenue rather than subscriptions

- Internet distribution: Content is delivered via broadband internet rather than cable or satellite

- Free access: No subscription fees or pay-per-view charges for viewers

- Professional curation: Programming is typically curated and scheduled by content professionals

The Technology Behind FAST Channels

FAST channels utilize streaming technology protocols like HTTP Live Streaming (HLS) and Dynamic Adaptive Streaming over HTTP (DASH) to deliver content. The technical infrastructure includes:

- Content management systems for scheduling and playlist management

- Video encoding and transcoding services for multiple bitrate delivery

- Ad insertion technology for dynamic ad placement

- Content delivery networks (CDN) for global distribution

- Analytics and monitoring systems for performance tracking

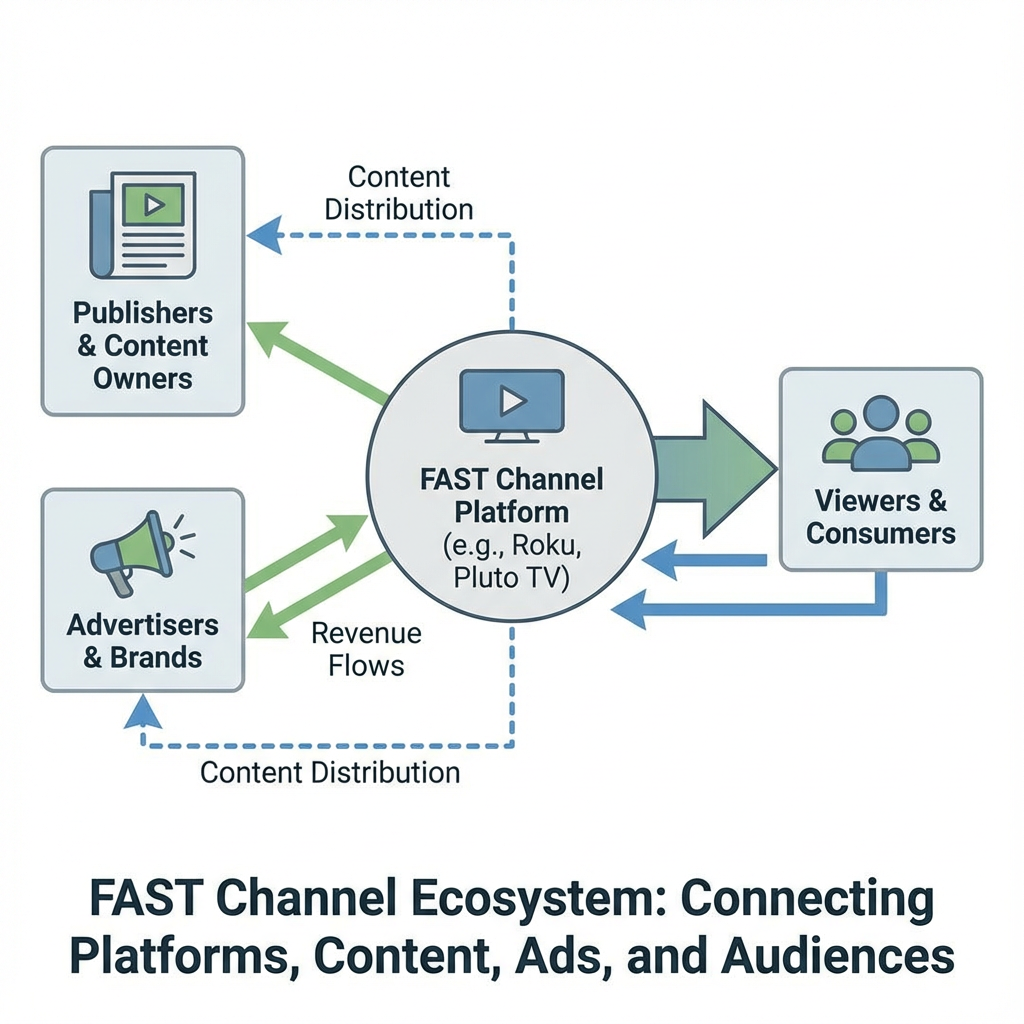

The FAST Channel Ecosystem

Major FAST Platforms

Several major platforms have established themselves as leaders in the FAST channel space:

Pluto TV: Launched in 2013 and acquired by ViacomCBS (now Paramount) in 2019, Pluto TV operates over 250 channels across various genres including news, entertainment, sports, and lifestyle content.

Tubi: Originally focused on on-demand content, Tubi expanded into FAST channels and now offers dozens of linear channels alongside its extensive library of movies and TV shows.

Samsung TV Plus: Pre-installed on Samsung smart TVs, this platform offers over 200 free channels and has become a significant player in the connected TV space.

LG Channels: Similar to Samsung TV Plus, LG Channels comes pre-installed on LG smart TVs and provides access to numerous FAST channels.

Roku Channel: Roku’s free streaming service combines on-demand content with linear FAST channels, leveraging Roku’s massive installed base of streaming devices.

Content Categories and Programming

FAST channels span virtually every content category:

- News and Current Affairs: 24/7 news channels, local news programming, and specialized news content

- Entertainment: Classic TV shows, reality programming, game shows, and variety content

- Sports: Live sports events, sports news, classic games, and niche sports content

- Lifestyle: Cooking shows, home improvement, travel, and wellness programming

- Movies: Dedicated movie channels often organized by genre or decade

- Kids and Family: Children’s programming, educational content, and family-friendly entertainment

- Music: Music videos, concerts, and music-focused programming

Monetization Models and Revenue Streams

Advertising-Based Revenue

The primary monetization model for FAST channels revolves around advertising revenue, which can be structured in several ways:

Traditional Ad Breaks: Similar to broadcast television, FAST channels insert commercial breaks at predetermined intervals during programming. These ad breaks typically range from 30 seconds to 3 minutes.

Programmatic Advertising: Many FAST channels utilize programmatic advertising technology to automatically sell and serve ads in real-time, optimizing for the highest bidder and most relevant content.

Direct Sales: Publishers often maintain direct relationships with advertisers, selling premium inventory at higher rates than programmatic channels.

Revenue Sharing Models

FAST platforms typically employ revenue-sharing arrangements with content providers:

- Platform Revenue Share: Major platforms like Pluto TV and Tubi typically keep 50-70% of advertising revenue, with content providers receiving the remainder

- Content Licensing Fees: Some arrangements include upfront licensing fees in addition to revenue sharing

- Performance Bonuses: Additional payments based on viewership milestones or engagement metrics

Monetization Challenges and Opportunities

While FAST channels offer significant monetization potential, publishers face several challenges:

Ad Load Balance: Finding the optimal balance between ad revenue and viewer experience requires careful consideration of ad frequency and placement.

Audience Measurement: Unlike traditional TV with established Nielsen ratings, FAST channel audience measurement varies across platforms and may not align with traditional buying patterns.

Competition for Inventory: As more FAST channels launch, competition for advertising dollars intensifies, potentially impressing CPM rates.

Implementation Strategies for Publishers

Content Strategy Development

Successful FAST channel implementation begins with a well-defined content strategy:

Archive Content Utilization: Publishers can monetize extensive content libraries that may have limited revenue potential in other formats. Classic TV shows, older movies, and evergreen content perform well in FAST environments.

Niche Programming: FAST channels allow publishers to serve specific audience segments that might not be viable for traditional broadcast but can attract dedicated viewers and targeted advertising.

Programming Blocks: Creating themed programming blocks (e.g., ”80s Movie Night” or “Morning News Update”) helps establish viewer habits and improves retention.

Technical Implementation

Launching a FAST channel requires significant technical infrastructure:

Playout Systems: Publishers need reliable playout systems that can manage scheduled programming, handle live inputs, and seamlessly integrate advertising content.

Encoding and Delivery: Content must be encoded in multiple bitrates and delivered through robust CDN networks to ensure consistent quality across different devices and connection speeds.

Ad Integration: Server-side ad insertion (SSAI) technology is crucial for delivering a television-like viewing experience without buffering or quality issues during ad transitions.

For publishers looking to implement video solutions that support FAST channel delivery, platforms like Veedmo provide the necessary infrastructure for content management and distribution across multiple channels and devices.

Platform Distribution Strategy

Multi-Platform Approach: Successful FAST channel publishers typically distribute across multiple platforms to maximize reach and reduce dependency on any single platform.

Platform-Specific Optimization: Each FAST platform has unique technical requirements, audience demographics, and content guidelines that require tailored approaches.

Direct Distribution: Some publishers choose to launch their own FAST channels through connected TV apps and streaming devices, maintaining greater control over the viewer experience and revenue.

Ad Operations and Optimization

Ad Tech Integration

Effective FAST channel ad operations require sophisticated technology integration:

Supply-Side Platforms (SSPs): These platforms help publishers maximize ad revenue by connecting to multiple demand sources and optimizing yield across different advertising channels.

Header Bidding: Advanced publishers implement header bidding solutions to increase competition for ad inventory and improve CPMs.

Real-Time Bidding (RTB): Programmatic advertising through RTB allows for dynamic pricing and targeting, maximizing revenue potential for each ad impression.

Audience Data and Targeting

First-Party Data Collection: FAST channels provide opportunities to collect valuable first-party data through viewer registration, content preferences, and viewing behavior.

Cross-Device Tracking: Understanding how viewers consume content across different devices helps optimize both content programming and advertising targeting.

Demographic and Behavioral Targeting: Leveraging audience data enables more precise advertising targeting, leading to higher CPMs and better advertiser performance.

Performance Metrics and Optimization

Key performance indicators for FAST channel success include:

- Average Revenue Per User (ARPU): Tracking revenue generation per viewer over time

- Time Spent Watching: Measuring engagement through average viewing duration and session length

- Return Viewership: Understanding how often viewers return to the channel

- Ad Completion Rates: Monitoring how frequently viewers watch ads to completion

- Cost Per Mille (CPM): Tracking advertising rates and revenue optimization

Industry Trends and Future Outlook

Market Growth Projections

The FAST channel market has experienced explosive growth, with industry analysts projecting continued expansion. According to various industry reports, FAST channel viewership has grown over 200% year-over-year, and advertising revenue is expected to reach $4.6 billion by 2025.

Emerging Trends

Local Content Focus: Increasingly, FAST channels are incorporating local news, weather, and community programming to attract regional audiences and local advertising dollars.

Interactive Features: Some platforms are experimenting with interactive elements, allowing viewers to engage with content through polls, quizzes, and social features while maintaining the linear viewing experience.

Advanced Personalization: While maintaining linear programming, platforms are beginning to offer personalized channel recommendations and customized ad experiences based on viewer preferences and behavior.

International Expansion: Major FAST platforms are expanding globally, creating opportunities for international content distribution and advertising revenue.

Challenges and Considerations

Content Costs: As competition increases, content licensing costs are rising, potentially impacting profitability margins.

Ad Fraud Prevention: The programmatic nature of much FAST channel advertising requires robust fraud prevention measures to maintain advertiser confidence.

Regulatory Compliance: FAST channels must navigate various regulatory requirements, including content standards, accessibility compliance, and data privacy regulations.

Conclusion

FAST channels represent a significant opportunity for publishers to monetize content while meeting evolving viewer preferences for free, accessible entertainment. Success in this space requires careful attention to content strategy, technical implementation, and ad operations optimization.

As the streaming landscape continues to evolve, FAST channels are positioned to capture increasing market share from traditional broadcast television while offering publishers a sustainable, advertising-supported revenue model. Publishers who can effectively balance viewer experience with monetization opportunities will find FAST channels to be a valuable addition to their content distribution and revenue strategies.

The key to success lies in understanding audience preferences, optimizing technical delivery, and maintaining strong relationships with both content creators and advertising partners. As the industry matures, those publishers who invest in proper infrastructure and strategic planning will be best positioned to capitalize on the continued growth of the FAST channel ecosystem.